Are you considering launching a business in Arizona? Starting a Limited Liability Company (LLC) in Arizona could be the beginning of your business journey. This guide makes it easy to set up your LLC, giving you straightforward steps to follow. Whether you're experienced in business or just starting out, we're here to guide you through setting up your LLC smoothly and confidently.

Options for Forming an LLC in Arizona

- Do-It-Yourself (DIY): This is ideal for those comfortable with legal formalities and wishing to personally manage the setup process.

Go to the Arizona Corporations Commission to set up the LLC and then to the IRS’s website to get your EIN (Employer Identification Number). - Hiring a Lawyer: Best suited for those who require personalized legal advice, particularly in complex business scenarios.

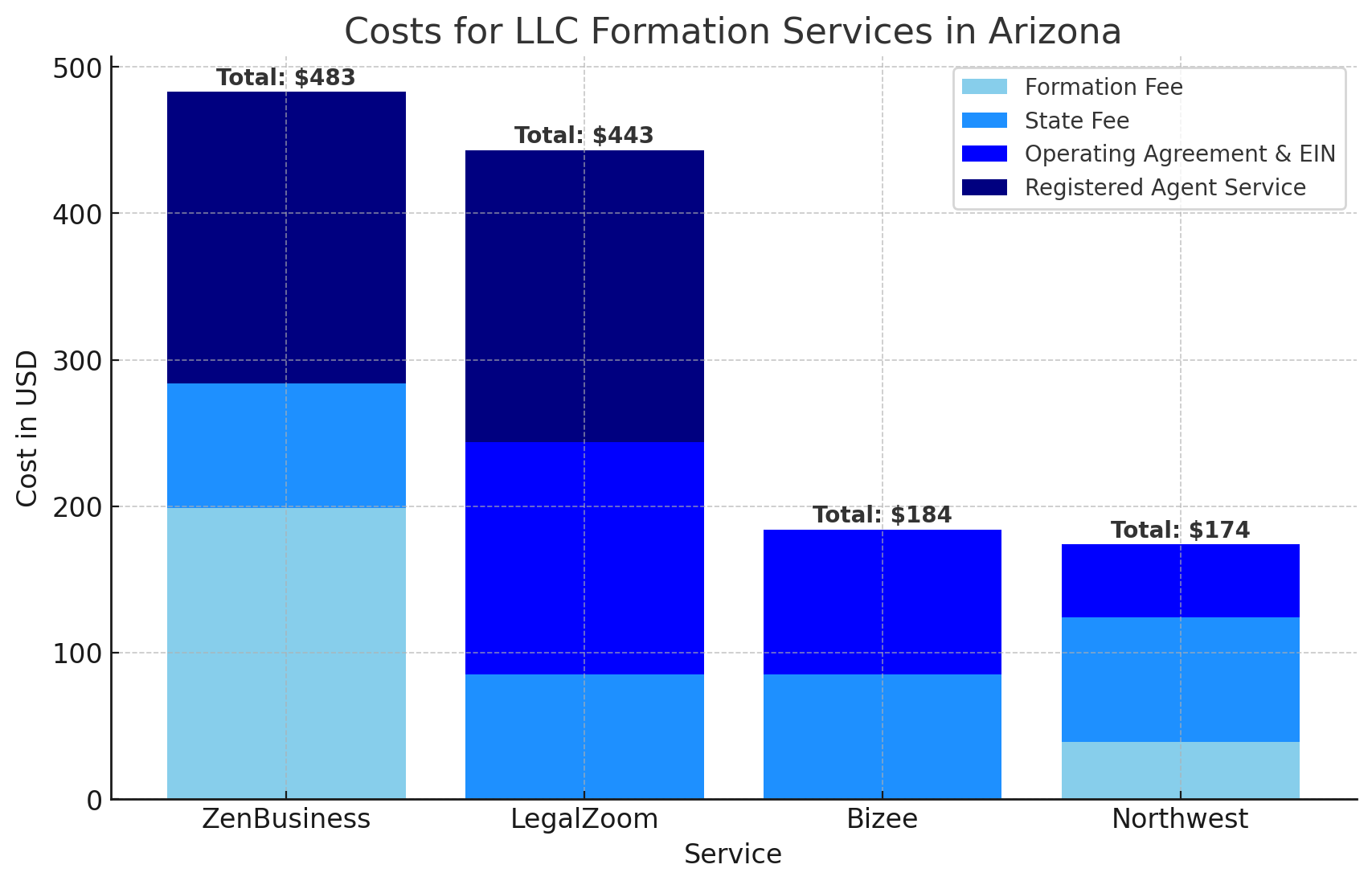

- Using a Formation Service: A practical choice for convenience and cost-effectiveness. Popular services include Incfile, ZenBusiness, LegalZoom, and our top recommendation, Northwest Registered Agent.

We’ll guide you through each step to ensure your LLC in Arizona is established smoothly, combining clarity with professional insights.

Steps to Form an LLC in Arizona

- Choose Your LLC’s Name: Your LLC name in Arizona must be unique and include “Limited Liability Company” or its abbreviations.

It should comply with Arizona’s specific naming guidelines, according to AZ Revised Statute § 29-3112. - Designate a Statutory Agent: Arizona requires appointing a statutory agent with a physical address in the state for handling legal correspondence.

- File the Articles of Organization: Essential for formalizing your LLC with the Arizona Corporation Commission. It includes your business name, address, statutory agent details, and management structure. The fee is $50, with an expedited option for $85.

- Draft an Operating Agreement: While not mandatory in Arizona, this document is crucial for outlining operational and management procedures of your LLC.

- Obtain an Employer Identification Number (EIN): Necessary for tax and employment purposes, available through the IRS website.

- Open a Business Bank Account: Essential for financial management and maintaining the integrity of your LLC’s finances.

- Funding Your LLC: Inject capital through personal investments, loans, or other funding sources.

- Ongoing Compliance: Comply with Arizona-specific requirements, including transaction privilege tax and potential publication of your LLC formation.

Using Northwest Registered Agent for Arizona LLC Formation

Northwest Registered Agent simplifies LLC formation in Arizona. If you use our affiliate link below

you can set up your LLC in Arizona for only $39 plus state fees. This fee includes their registered agent services free for the first year, adding value to their offering.

We get commissions for purchases made through links in this post.

Legal Considerations and Compliance in Arizona

Compliance is crucial in Arizona. Ensure your LLC's name and statutory agent meet state requirements. Pay attention to specific state obligations, such as the potential publication requirement for your LLC.

Benefits of an Arizona LLC

Forming an LLC in Arizona offers limited liability protection, favorable tax treatment, and flexibility in management. Arizona's growing economy and business-friendly environment present numerous opportunities across various sectors.

Common Pitfalls to Avoid

Be vigilant about state-specific legal requirements and avoid mixing personal and business finances. Stay informed, compliant, and consider professional services where necessary.

Next Steps After Forming Your Arizona LLC

After setting up your LLC, focus on operational aspects such as crafting a robust business plan, establishing accounting systems, and marketing your services or products. Leverage business management tools and services for a successful journey.

Conclusion

Starting an LLC in Arizona offers various pathways, each with its advantages. Whether you choose DIY, hiring a lawyer, or using a formation service like Northwest Registered Agent, each method has its unique merits. The key is to select the path that aligns with your needs, ensuring your LLC is established correctly and promptly.

Start an LLC in Arizona FAQs

Can you be your own registered agent in Arizona?

Yes, but if you act as your own registered agent in Arizona, your name and address will be publicly listed. You'll need to be available during regular business hours to receive any legal documents in person.

Can I change my registered agent after I start an LLC?

Yes, you can change your registered agent in Arizona by filling out and submitting the Statement of Change form with the Arizona Corporations Commission and pay a $5 fee.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my Arizona LLC?

Yes, you need an EIN if your business has employees, is a multi-member LLC, or is taxed as a corporation. Even if your LLC isn't legally obligated to have an EIN, it's advisable. An EIN allows you to open bank accounts, apply for business licenses, and is generally essential for business operations. It also helps keep your Social Security Number (SSN) private during business transactions.