Are you thinking about starting your own business in California? Creating a Limited Liability Company (LLC) there can be the first thing you do for success. This guide makes it easy for you to set up your LLC in California by explaining the steps in simple terms. Whether you've run a business before or it's your first time, we're here to help you understand everything easily.

What are the Options for Forming an LLC in California?

- Do-It-Yourself (DIY): This option is best suited for those who are comfortable with legal procedures and prefer to handle the process independently.

Go to the California Secretary of State’s website to set up the LLC and then to the IRS’s website to get your EIN (Employer Identification Number). - Hiring a Lawyer: Ideal for those seeking personalized legal advice, especially in more complex scenarios.

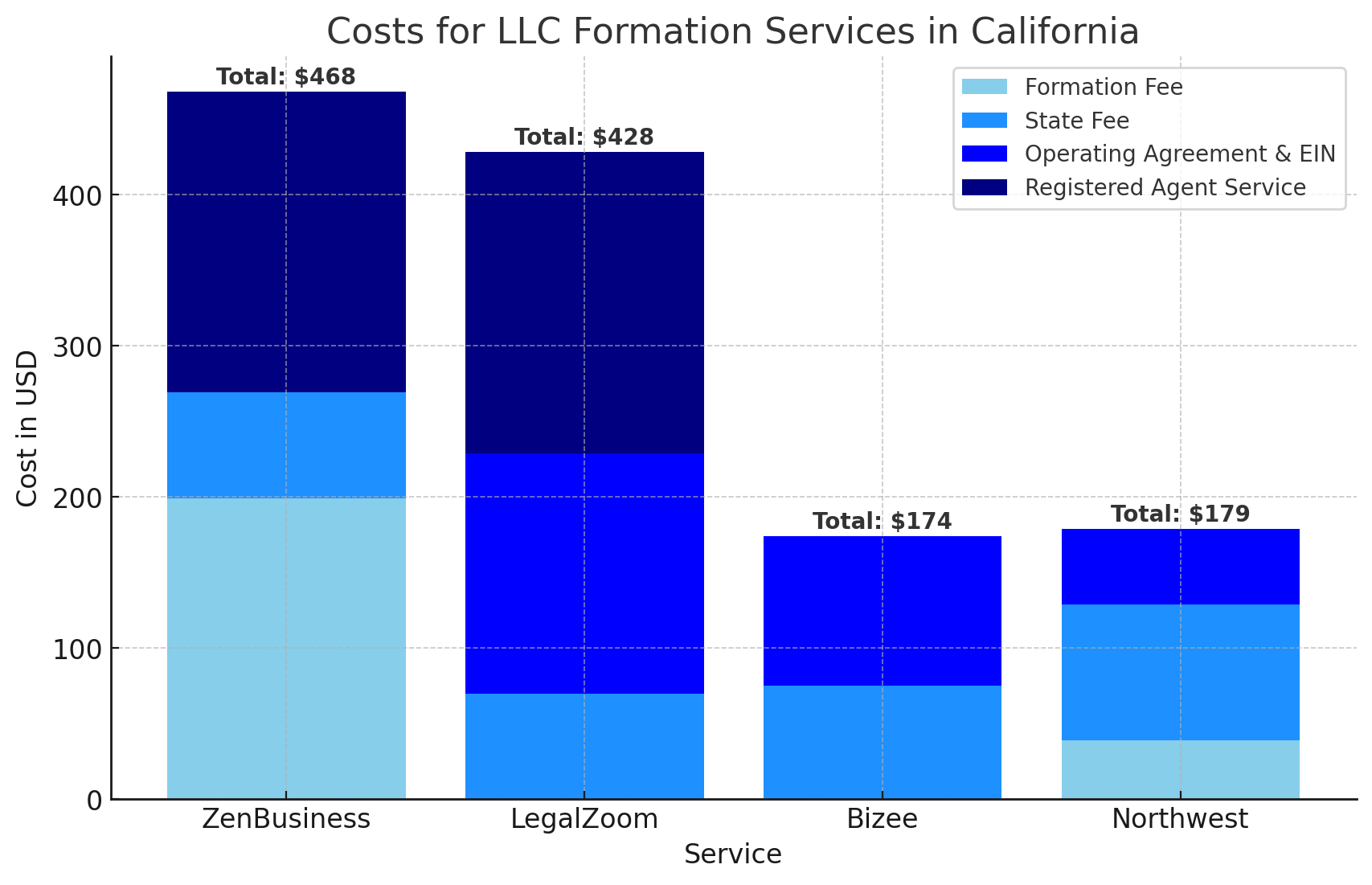

- Using a Formation Service: A popular and efficient choice for its convenience and cost-effectiveness. Noteworthy services include Bizee, ZenBusiness, LegalZoom, and our recommended choice, Northwest Registered Agent.

This guide will walk you through each step of setting up your LLC in California, ensuring clarity and professional insights throughout the process.

Steps to Form an LLC in California

- Choose Your LLC’s Name: Your chosen name must be unique within California and include “Limited Liability Company” or its abbreviations. It's important to ensure that your LLC name adheres to California’s specific naming guidelines.

For more information, check out California’s name requirements—listed in CA Corp Code § 17701.08. - Designate a Registered Agent: In California, it's necessary to appoint a registered agent with a physical street address to manage official legal correspondence for your LLC.

- File the Articles of Organization: Submit this crucial document to the California Secretary of State. It includes vital details about your LLC, such as the business name, address, registered agent information, and management structure.

The filing fee in California is $90. - Draft an Operating Agreement: While not legally required in California, an operating agreement is essential for outlining your LLC's operational and management procedures.

- Obtain an Employer Identification Number (EIN): Necessary for tax purposes and hiring employees, you can apply for an EIN through the IRS website.

- Open a Business Bank Account: A separate bank account for your LLC is crucial to maintain financial integrity and manage your business finances effectively.

- Fund Your LLC: Inject capital into your business through personal investments, loans, or other funding sources.

- Ongoing Compliance: Stay compliant by paying the annual California franchise tax and filing biennial Statements of Information.

Setting Up Your LLC with Northwest Registered Agent

For a streamlined and stress-free LLC formation process, consider Northwest Registered Agent. If you use our affiliate link below

you can set up your LLC in California for only $39 plus state fees. This fee includes their registered agent services free for the first year, adding value to their offering.

We get commissions for purchases made through links in this post.

Legal Considerations and Compliance

In California, compliance is key. Ensure your LLC name meets state requirements and that your registered agent is always available during business hours. Remember, your annual franchise tax is a must-pay, and keeping up with biennial filings keeps your LLC in good standing.

Benefits of Forming an LLC in California

An LLC in California offers limited liability protection, tax advantages, and operational flexibility. The state's diverse economy provides a fertile ground for businesses across various sectors, opening doors to limitless possibilities.

Common Pitfalls to Avoid

Avoid common mistakes like neglecting legal requirements or mixing personal and business finances. Stay informed and compliant, and consider professional services where necessary.

Next Steps After Forming Your LLC

Once your LLC is set up, focus on operational aspects like creating a robust business plan, setting up accounting systems, and marketing your services or products. Utilizing tools and services for business management can set you on a path to success.

Conclusion

Starting an LLC in California offers various pathways, each with its own merits. While some entrepreneurs may prefer the DIY approach or hiring a lawyer, many find that using a formation service like Northwest Registered Agent is the most efficient and cost-effective method. They simplify the process, ensuring that your LLC is established correctly and promptly.

Start an LLC in California FAQs

Can you be your own registered agent in California?

Yes, but if you act as your own registered agent in California, your name and address will be publicly listed. You'll need to be available during regular business hours to receive any legal documents in person.

Can I change my registered agent after I start an LLC?

Yes, you can change your registered agent in California by filling out and submitting the Change of Registered Agent form to the state's Business Services Division. There is a fee of $20 for this service.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my California LLC?

Yes, you need an EIN if your business has employees, is a multi-member LLC, or is taxed as a corporation. Even if your LLC isn't legally obligated to have an EIN, it's advisable. An EIN allows you to open bank accounts, apply for business licenses, and is generally essential for business operations. It also helps keep your Social Security Number (SSN) private during business transactions.