Starting a business venture in Georgia? Forming a Limited Liability Company (LLC) is a pivotal move to turn your business aspirations into reality. This guide simplifies the process of establishing your LLC in Georgia, presenting each step in a clear, straightforward manner. Whether you're a budding entrepreneur or a veteran in the business world, this article will navigate you through the key elements of Georgia LLC formation.

Options for Forming an LLC in Georgia

- Do-It-Yourself (DIY): Suitable for those who are comfortable with legal procedures and prefer to manage things independently.

Go to the Georgia Corporations Division of the Secretary of State’s website to set up the LLC and then to the IRS’s website to get your EIN (Employer Identification Number). - Hiring a Lawyer: Ideal for getting personalized legal advice, particularly in complex situations.

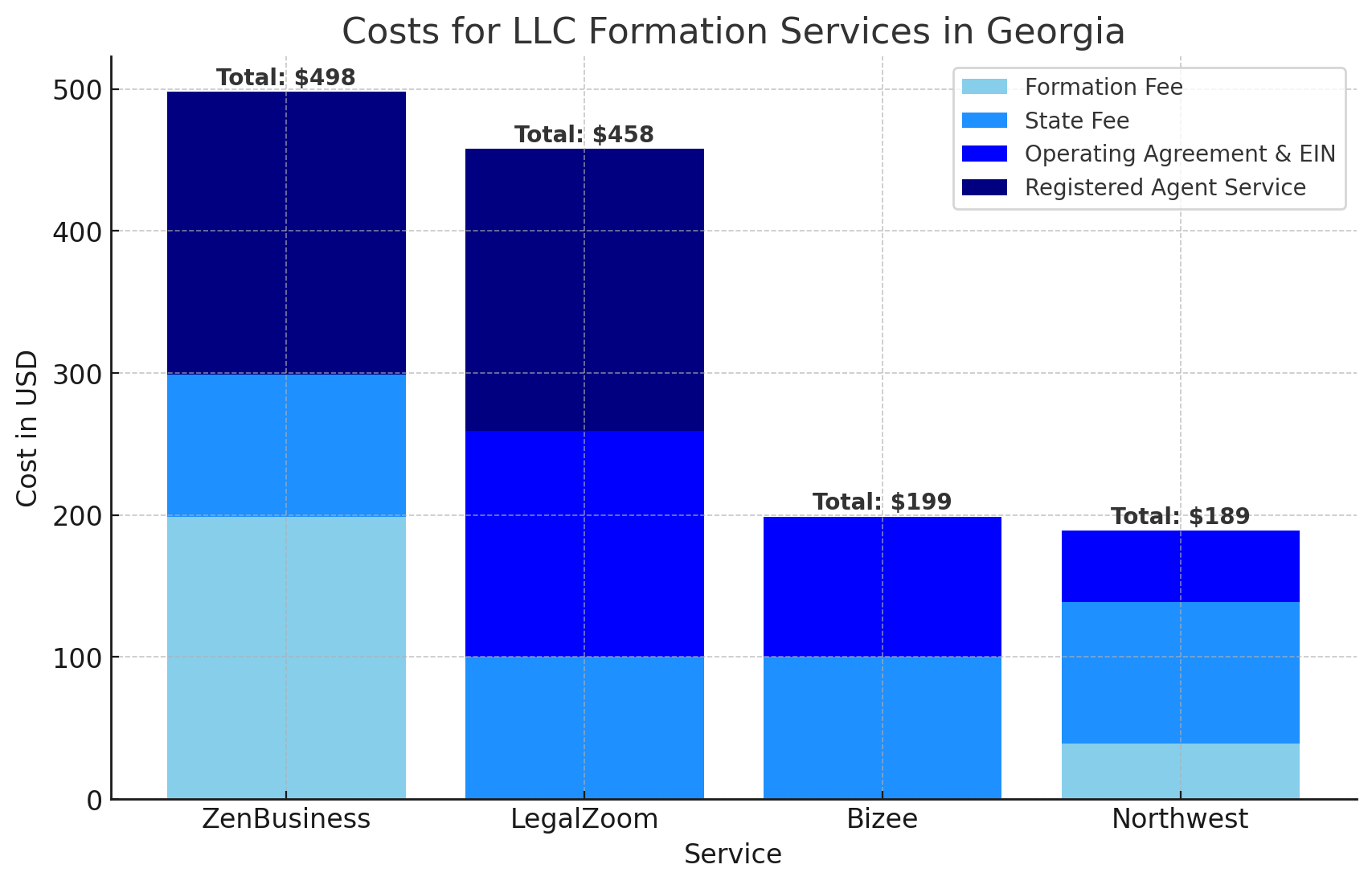

- Using a Formation Service: A cost-effective, efficient option for many. Prominent services include ZenBusiness, LegalZoom, Bizee, and our top choice, Northwest Registered Agent.

This guide aims to offer clear, expert guidance at every step of your Georgia LLC formation journey.

Steps to Form an LLC in Georgia

- Choose Your LLC’s Name: Your chosen name must be unique in Georgia and include “Limited Liability Company” or its abbreviations. Adhering to Georgia’s naming guidelines is crucial. Georgia’s rules for naming LLCs are detailed in the Code of Georgia (GA Code § 14-11-207).

- Designate a Registered Agent: Georgia law requires appointing a registered agent with a physical address in the state to handle your LLC's legal documents.

- File the Articles of Organization: Submit this vital document to the Georgia Secretary of State. It contains your LLC’s name, address, registered agent, and management structure.

The filing fee is $100 online, with a $10 additional charge for physical filings. - Draft an Operating Agreement: While not legally mandated in Georgia, an operating agreement is vital for outlining your LLC's operational and managerial frameworks.

- Obtain an Employer Identification Number (EIN): Essential for tax and employment purposes, obtainable from the IRS website.

- Open a Business Bank Account: Separate your personal and business finances by creating a bank account specifically for your LLC.

- Fund Your LLC: Capitalize your business through personal investments, loans, or other funding sources.

- Ongoing Compliance: File an Annual Registration and pay the $50 fee to maintain your LLC's good standing in Georgia.

Establishing Your LLC with Northwest Registered Agent

Northwest Registered Agent simplifies the LLC formation process. By clicking on the button below, you can use our affiliate link

and form your LLC in Georgia for only $39, plus state fees. This exclusive offer includes their registered agent service free for the first year, adding extra value and savings for your new venture.

We get commissions for purchases made through links in this post.

Legal Considerations and Compliance in Georgia

It's vital to comply with Georgia-specific regulations. Ensure your LLC name meets state criteria and maintain an accessible registered agent during business hours. The Annual Registration is crucial to keep your LLC compliant.

Benefits of Forming an LLC in Georgia

A Georgia LLC provides limited liability protection, potential tax benefits, and flexibility in operations. The state’s business-friendly environment offers numerous opportunities for growth across various sectors.

Common Mistakes to Avoid

Be wary of common pitfalls such as overlooking legal obligations or blending personal and business finances. Stay informed, comply with state laws, and consider professional services when needed.

Next Steps After Establishing Your LLC

After formation, concentrate on developing a solid business plan, establishing robust accounting systems, and promoting your services. Utilize tools and services for efficient business management to ensure a successful journey.

Conclusion

Forming an LLC in Georgia offers different routes, each with distinct benefits. Entrepreneurs may opt for DIY, legal guidance, or efficient services like Northwest Registered Agent.

They streamline the setup process, ensuring your LLC is established correctly and efficiently.

Start an LLC in Georgia FAQs

Can you be your own registered agent in Georgia?

Yes, but if you act as your own registered agent in Georgia, your name and address will be publicly listed. You'll need to be available during regular business hours to receive any legal documents in person.

Can I change my registered agent after I start an LLC?

Yes. To change your registered agent in Georgia, use this link. You will need to file an Annual Registration form to the Secretary of State and pay the $50 fee.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my Georgia LLC?

Yes, you need an EIN if your business has employees, is a multi-member LLC, or is taxed as a corporation. Even if your LLC isn't legally obligated to have an EIN, it's advisable. An EIN allows you to open bank accounts, apply for business licenses, and is generally essential for business operations. It also helps keep your Social Security Number (SSN) private during business transactions.