Thinking of launching your business in Iowa? Establishing a Limited Liability Company (LLC) might be the right step for you.

This article is designed to simplify the LLC formation process in Iowa, presenting each step in an easy-to-understand manner. Whether you're a novice or seasoned in business matters, this guide will navigate you through the nuances of Iowa LLC formation.

Options for Forming an LLC in Iowa

- Do-It-Yourself (DIY): For those comfortable with navigating legal procedures independently.

Go to the Iowa Secretary of State’s website to set up the LLC and then to the IRS’s website to get your EIN (Employer Identification Number). - Hiring a Lawyer: Best suited for tailored legal advice, especially in complex business matters.

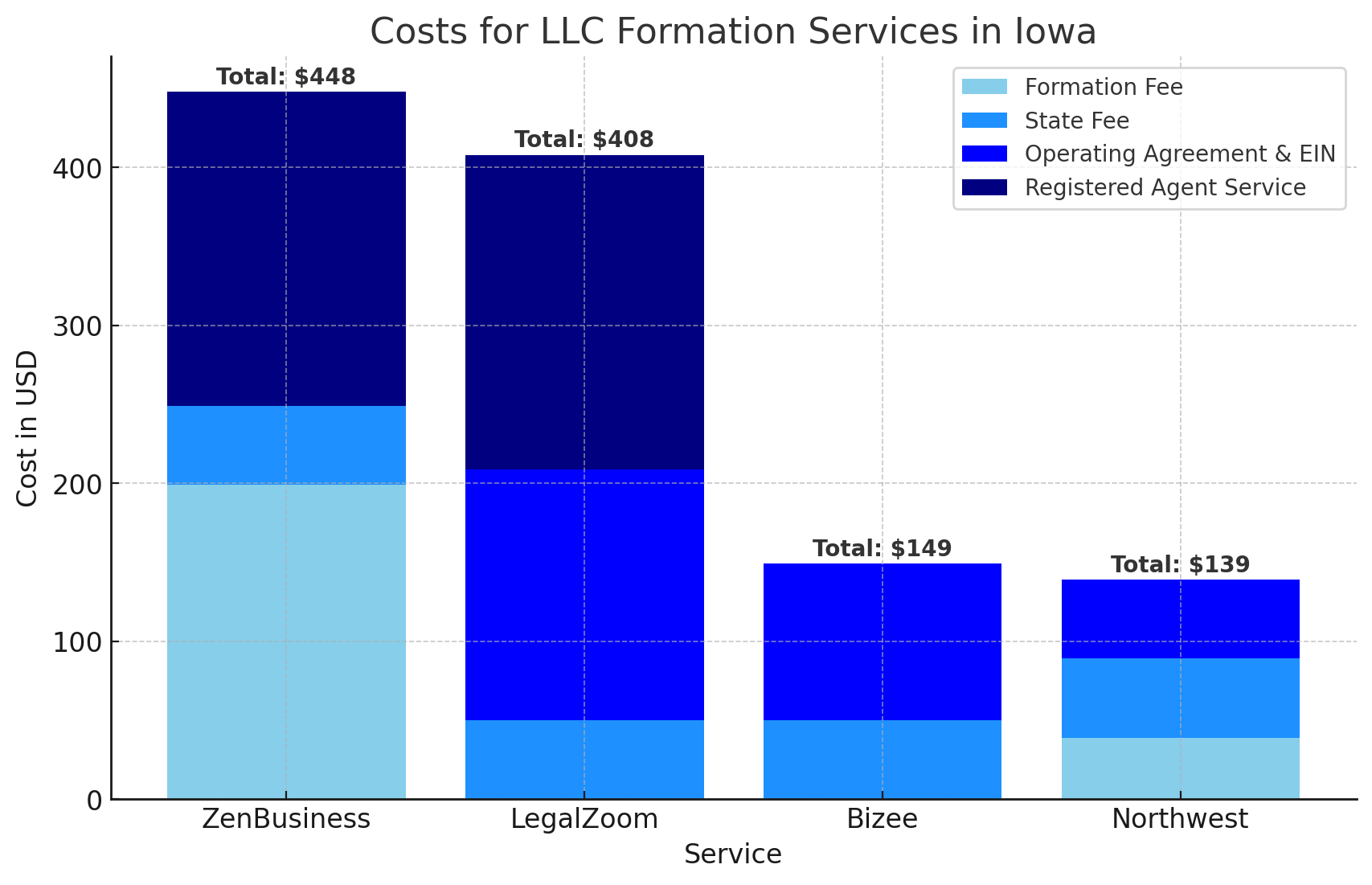

- Using a Formation Service: A cost-effective option for many. Recommended services include Bizee, ZenBusiness, LegalZoom, and Northwest Registered Agent.

This guide is tailored to provide clear and expert guidance at each phase of your Iowa LLC formation journey.

Steps to Form an LLC in Iowa

- Choose Your LLC’s Name: Ensure the name is unique in Iowa and includes “Limited Liability Company” or its abbreviations.

Complying with Iowa’s naming guidelines is essential. Iowa’s rules for naming LLCs are detailed in Iowa Code § 489.108. - Designate a Registered Agent: Iowa law mandates a registered agent with a physical address in Iowa for handling your LLC's legal paperwork.

- File the Certificate of Organization: Submit this key document to the Iowa Secretary of State. It includes your LLC’s name, address, registered agent, and management structure. The filing fee is $50.

- Draft an Operating Agreement: Not mandated by Iowa law but recommended for outlining the LLC's operational and management specifics.

- Obtain an Employer Identification Number (EIN): Essential for tax and employment purposes, available through the IRS website.

- Open a Business Bank Account: Crucial for separating personal and business finances.

- Fund Your LLC: Capitalize your business through investments, loans, or other financial means.

- File Biennial Reports: Keep your LLC in good standing by filing reports every two years with the required fee.

Establishing Your LLC with Northwest Registered Agent

Northwest Registered Agent simplifies the LLC formation process. By clicking on the button below, you can use our affiliate link

and form your LLC in Iowa for only $39, plus state fees. This exclusive offer includes their registered agent service free for the first year, adding extra value and savings for your new venture.

We get commissions for purchases made through links in this post.

Legal Considerations and Compliance in Iowa

Compliance with state-specific regulations, like maintaining a registered agent and filing periodic reports, is essential for running your LLC smoothly in Iowa.

Benefits of Forming an LLC in Iowa

Iowa LLCs enjoy limited liability protection, potential tax benefits, and operational flexibility, contributing to a conducive business environment for various sectors.

Common Mistakes to Avoid

Bypass errors such as overlooking legal requirements and mingling personal with business finances. Stay informed and consider professional services if needed.

Next Steps After Establishing Your LLC

Develop a robust business plan, set up efficient accounting systems, and begin marketing your business. Leverage tools and resources for effective business management.

Conclusion

An LLC in Iowa offers different paths to formation, each with distinct advantages. Entrepreneurs may choose DIY, legal assistance, or formation services like Northwest Registered Agent for a streamlined and cost-effective setup.

Start an LLC in Iowa FAQs

Can you be your own registered agent in Iowa?

Yes, but if you act as your own registered agent in Iowa, your name and address will be publicly listed. You'll need to be available during regular business hours to receive any legal documents in person.

Can I change my registered agent after I start an LLC?

Yes. To change your registered agent in Iowa, use this link. You just need to submit a Statement of Change of Registered Agent form with the Iowa Secretary of State. It’s free to change your registered agent in Iowa.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my Iowa LLC?

Yes, you need an EIN if your business has employees, is a multi-member LLC, or is taxed as a corporation. Even if your LLC isn't legally obligated to have an EIN, it's advisable. An EIN allows you to open bank accounts, apply for business licenses, and is generally essential for business operations. It also helps keep your Social Security Number (SSN) private during business transactions.