Starting and maintaining a Limited Liability Company (LLC) is a crucial step in setting up a successful business. However, understanding the costs involved can be challenging due to the varying fees by state and additional expenses related to formation services and ongoing compliance.

In this article, we will break down the costs associated with starting and maintaining an LLC in 2024, providing you with all the information you need to budget effectively.

Costs to Start an LLC in 2024

1. State Filing Fees

The first cost you will incur when starting an LLC is the state filing fee for submitting your LLC’s Articles of Organization. This fee is mandatory, and there is no way around it.

Filing fees vary significantly by state:

- Montana: $35 (cheapest)

- Massachusetts: $500 (most expensive)

- Florida: $125

- Texas: $300

- California: $70

- Delaware: $110

- Wyoming: $100

Most states fall within the range of $50 to $300. For an up-to-date list of filing fees across all 50 U.S. states, you can download the complete pricing guide.

2. LLC Formation Service Costs

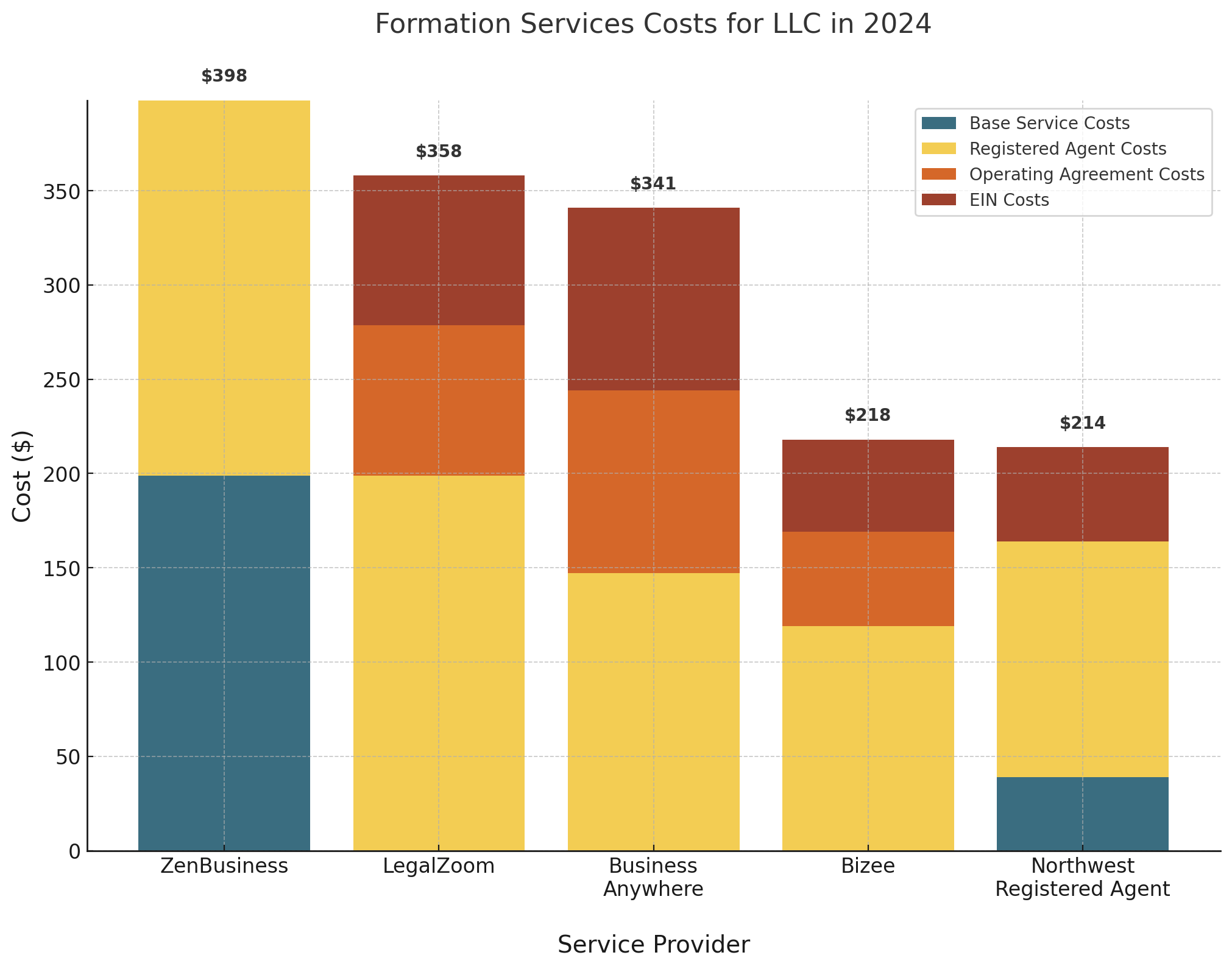

If you prefer assistance in filing the Articles of Organization, various LLC formation services are available. These services simplify the process and often provide additional benefits. Our top recommendation is Northwest Registered Agent, which charges $39 plus the state fee. Below, you will find a bar chart with the exact prices, and you'll see why we recommend Northwest.

Other options that you might consider are Business Anywhere, LegalZoom, ZenBusiness, and Bizee. If you choose Business Anywhere, you can save 15% on any add-ons with code: BEGIN15.

If you use some of our links, be aware that we may earn a commission at no additional cost to you if you purchase through the links provided.

3. Registered Agent Fees

When forming an LLC, you must designate a registered agent—either yourself or a hired service. The registered agent is responsible for receiving legal mail and state correspondence. If you act as your own registered agent, this is free, but it requires that you maintain regular business hours and have your address publicly listed on the Secretary of State’s website.

For privacy and convenience, many business owners prefer to hire a registered agent service. These services typically cost between $119 and $147 per year after the first year, which is often included for free when you form an LLC through services like Northwest Registered Agent.

4. Operating Agreement

An operating agreement is a contract that outlines how your LLC will operate, including the roles of members and the distribution of profits. While you can create your own operating agreement for free using templates provided by services like Northwest Registered Agent, more complex situations may require legal assistance.

Some services charge around $100 for an operating agreement template, while Business Anywhere offers a more customized service for $97, including help with modifications.

5. Employer Identification Number (EIN)

An Employer Identification Number (EIN) is essential for tax purposes and opening a business bank account. You can obtain an EIN for free directly from the IRS. If you prefer a guided approach, check our step-by-step guide on obtaining an EIN.

However, if you prefer to have your formation service obtain it for you, the cost usually ranges from $50 to $100. This fee may be higher for those outside the U.S. or without a Social Security Number due to the more complex process.

6. Beneficial Ownership Information Report

In 2024, LLCs are required to file a Beneficial Ownership Information Report with the Financial Crimes Enforcement Network (FinCEN). This report discloses the primary owners of the LLC. You can file this report for free on your own or pay a formation service $25 to $50 to handle it for you. The filing deadline is 90 days after forming your LLC in 2024, or 30 days if formed in 2025 and beyond.

7. Virtual Mailbox

If you work from home or don’t have a dedicated business office, you might consider getting a virtual mailbox. The registered agent’s address is only for legal mail, so a virtual mailbox ensures that all other business mail is handled properly. This service typically costs around $20 per month and is available from most LLC formation services or businesses like Anytime Mailbox.

8. Business Bank Account

Opening a business bank account is crucial for keeping your personal and business finances separate. You can do this for free, and it’s important to avoid banks that charge monthly maintenance fees if your average balance falls below a certain amount. Recommended options include BlueVine and American Express, which offer interest on business checking account balances.

Ongoing Costs to Maintain an LLC in 2024

Once your LLC is formed, there are ongoing costs to maintain it. These costs primarily involve filing annual reports and paying state fees, which vary by state.

Annual Report and Fees

- Florida: $138.75

- Delaware: $300

- Wyoming: $60

- California: $800 (+$20 for Statement of Information, biennial)

In some states, like Alaska or Iowa, you’ll file a biennial report:

- Alaska: $100

- Iowa: $30 (if filed online, otherwise $45)

Choosing the Right State for Your LLC

You may wonder if it’s beneficial to form your LLC in a state with lower costs, like Wyoming or Delaware. However, if you have a physical presence in a different state, you may also need to form a foreign LLC in that state and pay additional fees. For most businesses, it’s best to form an LLC in the state where you are physically located.

If you operate completely online or live outside the U.S., states like Wyoming and Delaware are popular choices due to their business-friendly environments.

Conclusion

Understanding how much it costs to start and maintain an LLC is essential for making informed decisions as you set up your business. From state filing fees to ongoing maintenance costs, this guide covers all the expenses you should consider. Whether you choose to handle everything yourself or use a formation service, knowing the costs involved will help you budget effectively and avoid surprises.

Frequently Asked Questions (FAQs)

Can I be my own registered agent?

Yes, but keep in mind your name and address will be publicly listed, and you must be available during business hours to receive legal documents.

What is the cost of filing an LLC in my state?

The cost varies by state, ranging from $35 in Montana to $500 in Massachusetts. Most states fall between $50 and $300.

Is it cheaper to form an LLC in a state with lower fees?

It depends. If you have physical operations in a different state, you may also need to form a foreign LLC and pay fees in both states. For most businesses, it’s best to form an LLC in the state where you are located.

What ongoing costs should I expect after forming an LLC?

Expect to file annual reports and pay state fees, which vary by state. Additional costs may include hiring a registered agent and maintaining a business bank account.