Starting an LLC in New York is a fantastic way to protect your personal assets while growing your business. Whether you're a first-time entrepreneur or an experienced business owner, this guide will walk you through how to start an LLC in New York with simple, clear steps. From naming your business to submitting the required documents, we'll cover everything you need to know.

By following the steps outlined here, you’ll be able to start an LLC in New York confidently and efficiently, saving time and avoiding common mistakes.

Options for Forming an LLC in New York

Do-It-Yourself (DIY): Ideal for those who are comfortable handling legal paperwork themselves.

- Go to the New York Department of State website to check the LLC name availability and file your Articles of Organization.

- Then, visit the IRS’s website to get your EIN (Employer Identification Number).

Hiring a Legal Expert: Recommended for obtaining specialized legal advice, especially for more complex business setups.

- A lawyer can guide you through the entire process, ensuring all legal aspects are properly handled.

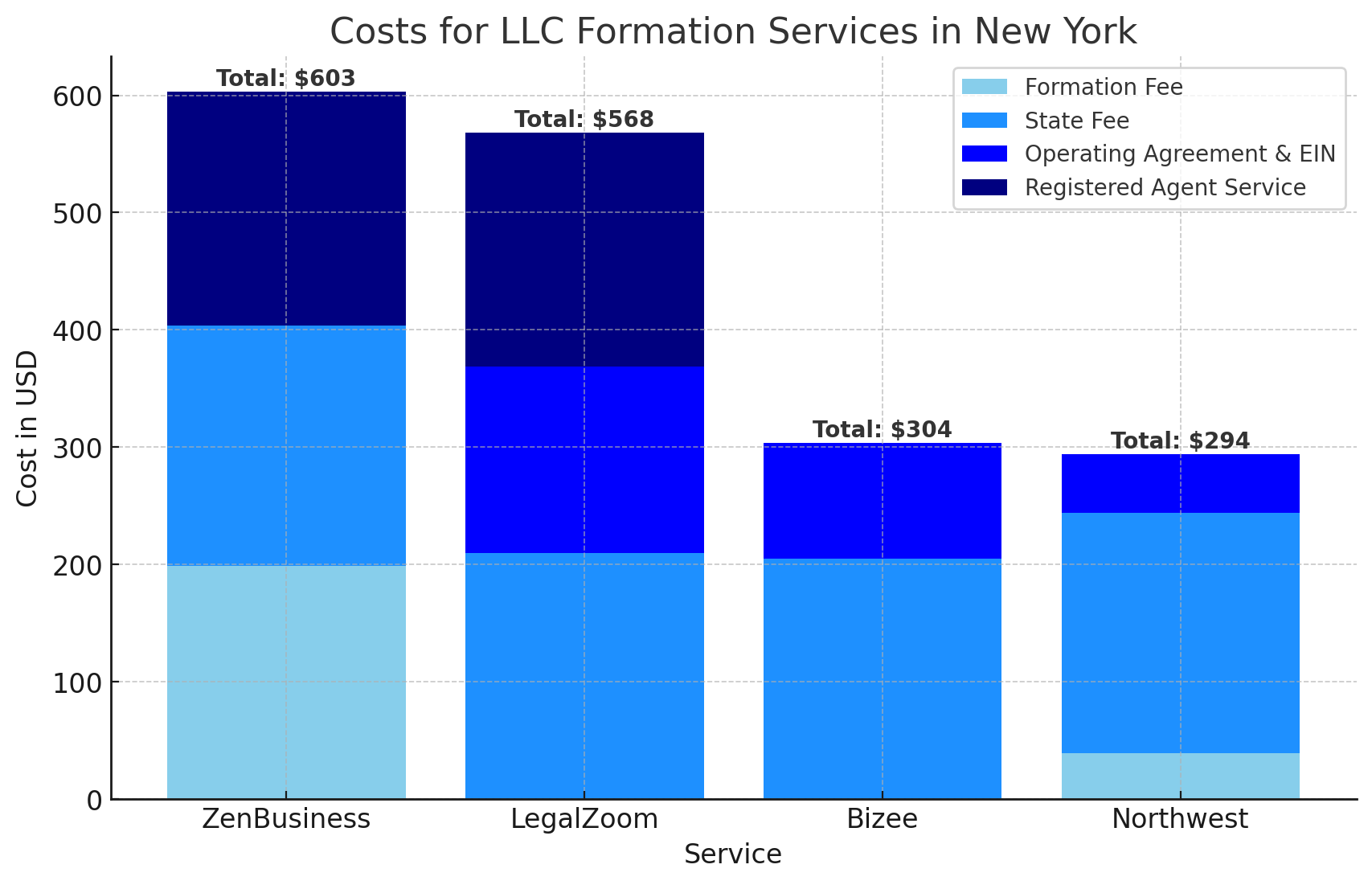

Utilizing a Formation Service: A cost-effective and time-saving option.

- Services like Northwest Registered Agent can handle everything from name checking to document filing. They offer to form your LLC for just $39 plus state fees and provide free registered agent services for the first year.

- Northwest also helps with the required New York publication for $375, covering newspaper announcement costs and state fees.

Steps to Start an LLC in New York

1. Choose a Unique Name for Your LLC

Your LLC's name must be unique in New York and adhere to specific guidelines:

- It must end with “LLC,” “L.L.C.,” or “Limited Liability Company.”

- It cannot include terms that could mislead the public, such as "corp" or "non-profit."

- Check the New York Department of State’s website to ensure your desired name is available.

2. Select a Registered Agent

A registered agent is required for all LLCs in New York. They receive legal documents on behalf of your business.

- You can choose to be your own registered agent, but this requires your address to be publicly listed and available during business hours.

- Hiring a registered agent service is recommended to protect your privacy. Northwest Registered Agent offers this service for $125 per year, with the first year free if they form your LLC.

3. File Your Articles of Organization

This is the document that officially forms your LLC. You can file it online or by mail with the New York Department of State.

- Filing fee: $200.

- If you'd like to expedite the process, you can pay an additional fee: $25 for 24-hour processing, $75 for same-day processing, or $150 for 2-hour processing.

- Once approved, you'll receive confirmation that your LLC is officially formed.

4. Publish an LLC Formation Announcement in Two Newspapers

New York requires that you publish a notice announcing your LLC’s formation in two newspapers (one daily and one weekly) for six consecutive weeks.

- The cost for this varies significantly depending on the county, ranging from a few hundred dollars to over $1,000.

- After publication, you’ll receive affidavits from the newspapers that you must file with the New York Department of State along with a $50 filing fee.

- Northwest Registered Agent offers to handle this entire process for $375, which includes the publication costs and the $50 state fee.

5. Obtain an Employer Identification Number (EIN)

An EIN is like a Social Security number for your business and is required for tax purposes, hiring employees, and opening a business bank account.

You can obtain your EIN for free directly from the IRS website. The process only takes a few minutes. If you prefer a guided approach, check our step-by-step guide on obtaining an EIN.

6. Create an Operating Agreement

An Operating Agreement outlines how your LLC will operate, including member roles and responsibilities. While New York doesn’t require one, it’s recommended—especially if you’re planning to open a business bank account.

You can use a free operating agreement template from Northwest Registered Agent.

7. Open a Business Bank Account

Opening a business bank account ensures you keep your personal and business finances separate. This is crucial for maintaining the liability protection that an LLC provides. You will need your EIN, Articles of Organization, and potentially your Operating Agreement to open a business bank account.

If you're looking to find the best 1st credit card for your business in 2024, check out our detailed review.

8. File a Beneficial Ownership Information Report

Starting in 2024, LLCs in New York are required to file a Beneficial Ownership Information Report with the Financial Crimes Enforcement Network (FinCEN).

This report must be filed within 90 days after forming your LLC in 2024, and within 30 days for LLCs formed in 2025 and beyond.

9. Comply with Ongoing New York State Requirements

To keep your LLC in good standing in New York, you must:

- Submit the Request for Information form to the New York Department of Taxation and Finance to set up your business tax account.

- Pay an annual filing fee to the Department of Taxation and Finance, based on your LLC’s gross income. This fee starts at $25 for businesses earning under $100,000 annually and increases for higher income brackets.

- File a Biennial Statement with the New York Department of State every two years. The filing fee is $9, and it ensures the state has up-to-date information about your LLC.

Forming Your LLC with Northwest Registered Agent

Northwest Registered Agent simplifies the process of LLC formation in Texas. By clicking on the button below, you can use our affiliate link and form your LLC in Texas for only $39, plus state fees. This exclusive offer includes their registered agent service free for the first year, adding extra value and savings for your new venture.

We earn commissions for purchases made through links in this post at no additional cost to you.

Why Choose Northwest Registered Agent?

- Affordable Pricing: Form your LLC for just $39 plus state fees.

- Free Registered Agent Service: Enjoy the first year free when you form your LLC.

- User-Friendly Process: Easily navigate the formation steps with expert support.

- Additional Services: Access to an operating agreement template and other business tools.

Conclusion

Forming an LLC in New York involves several steps, from naming your business to complying with state publication requirements. By following this guide, you can ensure that your LLC is set up properly and in compliance with New York state laws.

Whether you choose to handle the process yourself or use a formation service like Northwest Registered Agent, you’ll be on your way to successfully starting your LLC in New York.

Frequently Asked Questions (FAQs)

Can I be my own registered agent in New York?

Yes, you can act as your own registered agent in New York. However, your name and address will be publicly listed, and you must be available during regular business hours to receive any legal documents in person.

Do I need to publish a notice for my New York LLC?

Yes, New York requires you to publish a formation notice in two newspapers for six consecutive weeks. The cost varies by county but can range from a few hundred to over $1,000. Services like Northwest Registered Agent can handle this for $375.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my New York LLC?

Yes, you need an EIN if your business has employees, is a multi-member LLC, or is taxed as a corporation. Even if your LLC isn't legally required to have an EIN, it's advisable for opening bank accounts, applying for business licenses, and keeping your Social Security Number private during business transactions.