Starting an LLC in North Carolina is an excellent step for protecting your personal assets and providing a structured path to grow your business. Whether you’re a first-time entrepreneur or an experienced business owner, this guide will walk you through how to start an LLC in North Carolina with simple, easy-to-follow steps. From choosing your LLC name to filing the necessary documents, we’ve got everything you need to know.

Options for Forming an LLC in North Carolina

Do-It-Yourself (DIY): Ideal for those who are comfortable handling legal paperwork on their own.

- Visit the North Carolina Secretary of State’s website to check the LLC name availability and file your Articles of Organization.

- After that, head to the IRS website to obtain your EIN (Employer Identification Number).

Hiring a Legal Expert: Recommended for businesses with complex setups or those who prefer professional guidance.

- A lawyer can help ensure that all legal aspects are covered and compliant with North Carolina regulations.

Utilizing a Formation Service: A cost-effective and time-saving option.

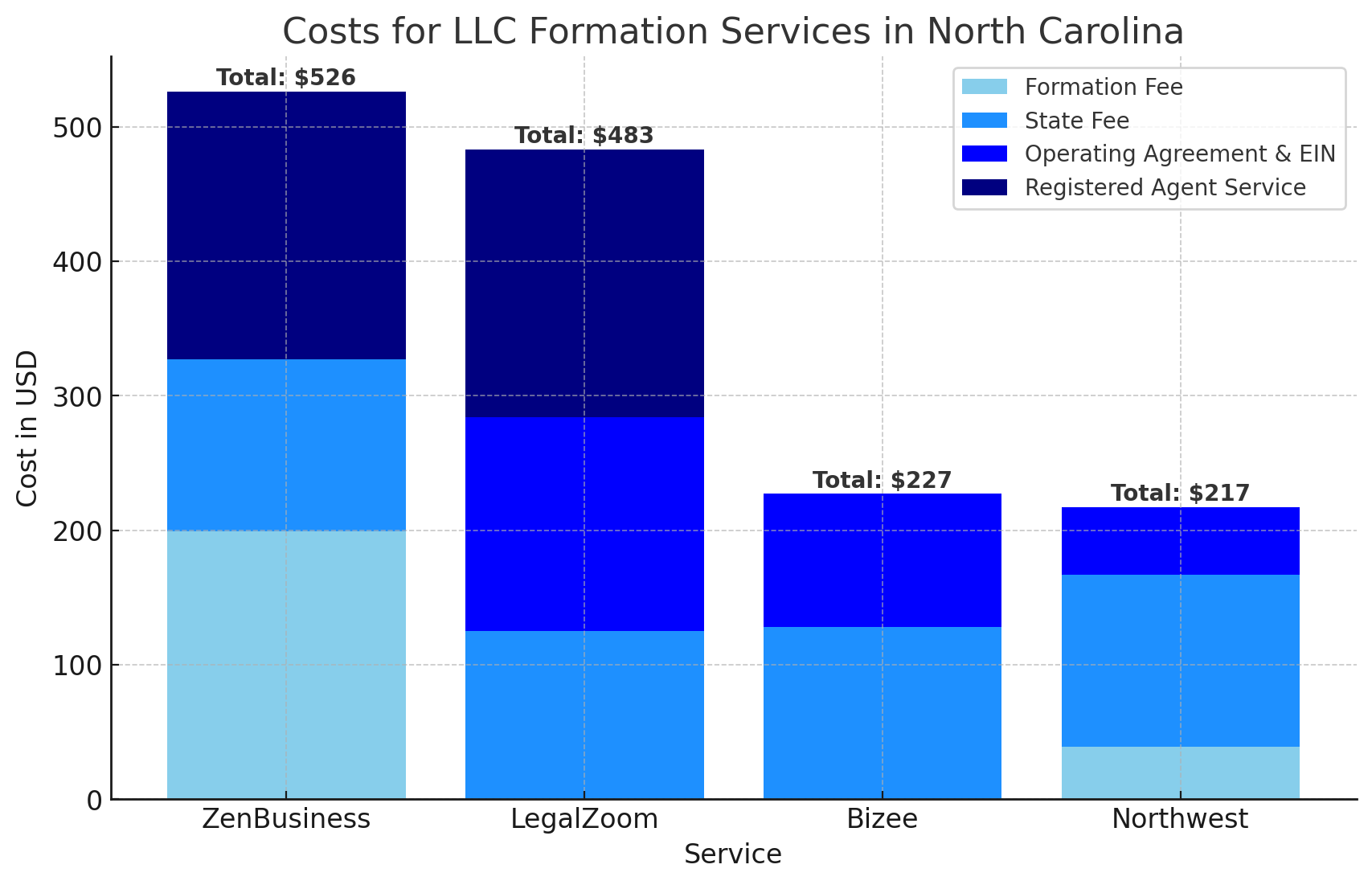

- Formation services such as Northwest Registered Agent will handle everything from name checking to filing your documents. They offer to form your LLC for just $39 plus state fees, and their registered agent service is free for the first year.

Steps to Start an LLC in North Carolina

1. Choose a Unique Name for Your LLC

Your LLC name must be unique in North Carolina and meet the following requirements:

- It must include "LLC," "L.L.C.," or "Limited Liability Company" in the name.

- It should avoid words that could confuse your business with a government agency, bank, or insurance company.

- Check the North Carolina Secretary of State’s website to ensure your desired name is available.

2. Select a Registered Agent

You are required to have a registered agent for your LLC. A registered agent is responsible for receiving legal documents on behalf of your business.

- The registered agent’s address will be publicly available, so many business owners prefer hiring a service to maintain privacy.

- Northwest Registered Agent offers registered agent services for $125 per year, and you get the first year free when forming your LLC with them.

3. File the Articles of Organization

To officially form your LLC, you must file the Articles of Organization with the North Carolina Secretary of State.

- The filing fee is $125. You can file online via the Secretary of State’s website or mail the Form L-01.

- If you need help, the state provides detailed instructions on how to fill out the form.

4. Obtain an Employer Identification Number (EIN)

An EIN is required for tax purposes and is necessary for opening a business bank account or hiring employees.

- You can get your EIN for free from the IRS website. The application process takes about 10 minutes and is straightforward.

- If you prefer a guided approach, check our step-by-step guide on obtaining an EIN.

5. Create an Operating Agreement

An Operating Agreement outlines how your LLC will be managed and operated. While not legally required in North Carolina, it’s highly recommended.

- Banks may require a copy of your Operating Agreement when opening a business bank account.

- You can use a free operating agreement template from Northwest Registered Agent.

6. Open a Business Bank Account

To keep your personal and business assets separate, it’s important to open a business bank account.

- This will help you manage finances more easily and maintain the liability protection your LLC provides.

- If you're looking to find the best 1st credit card for your business in 2024, check out our detailed review.

7. File a Beneficial Ownership Information Report

Starting in 2024, LLCs are required to file a Beneficial Ownership Information Report with the Financial Crimes Enforcement Network (FinCEN).

- You have 90 days to file this report after forming your LLC in 2024. From 2025 onwards, the report must be submitted within 30 days of forming your LLC.

8. File an Annual Report with the Secretary of State

To keep your LLC in good standing, you must file an annual report with the North Carolina Secretary of State.

- The annual report is due on April 15th each year, starting the year after your LLC is formed.

- The filing fee is $200 ($203 if filing online). You can file online using the Secretary of State’s website.

Why Use Northwest Registered Agent?

Northwest Registered Agent simplifies the process of forming an LLC in North Carolina. They charge just $39 plus state fees and provide free registered agent services for the first year, which saves you time and money.

Benefits of using Northwest Registered Agent include:

- Affordable Pricing: Form your LLC for just $39 plus state fees.

- Free Registered Agent Service: First year free when you form your LLC.

- User-Friendly Process: Easy-to-follow steps and expert support.

- Additional Services: Access to templates for Operating Agreements and other business tools.

Conclusion

Starting an LLC in North Carolina in 2024 requires several important steps, but by following this guide, you can ensure the process is smooth and efficient. Whether you choose to handle the process yourself or use a formation service like Northwest Registered Agent, it’s crucial to set up your business correctly to protect your personal assets and establish a solid foundation for growth.

Frequently Asked Questions (FAQs)

How much does it cost to start an LLC in North Carolina?

The cost to form an LLC in North Carolina includes a $125 filing fee for the Articles of Organization. Additional costs may arise if you expedite the filing or hire a registered agent service.

Do I need a registered agent for my LLC in North Carolina?

Yes, North Carolina requires you to have a registered agent. You can act as your own, but most business owners prefer hiring a professional service to maintain privacy and ensure legal documents are handled properly.

How long does it take to form an LLC in North Carolina?

Standard processing time is around 16 days. If you need your LLC processed faster, you can expedite the process for an additional fee.

What is an EIN, and do I need one for my LLC?

An Employer Identification Number (EIN) is like a Social Security number for your business. It’s required for tax purposes, hiring employees, and opening a business bank account. You can obtain one for free from the IRS website.

What happens if I don’t file my annual report on time?

If you fail to file your annual report by April 15th each year, your LLC could lose its good standing with the state, which could lead to penalties or even dissolution.