Starting an LLC in Wyoming is a popular choice among entrepreneurs thanks to its low fees and business-friendly regulations. Whether you’re a first-time business owner or an experienced entrepreneur, this guide will walk you through the steps on how to start an LLC in Wyoming in 2024. We’ve made sure to use simple, clear language, while keeping it professional so that everyone can follow along confidently.

In this article, we’ll cover everything from checking if your desired business name is available to filing the necessary documents and maintaining your LLC in Wyoming. Keep reading for a comprehensive guide on how to start an LLC in Wyoming, including key tips to save you time and money.

Options for Forming an LLC in Wyoming

Do-It-Yourself (DIY): Ideal for those who are comfortable with handling legal paperwork themselves.

You can check your LLC name availability and file your Articles of Organization directly through the Wyoming Secretary of State’s website. After that, visit the IRS website to get your EIN (Employer Identification Number).

Hiring a Legal Expert: Recommended for more complex business setups.

A lawyer can guide you through all legal formalities, ensuring you meet every requirement properly and efficiently.

Utilizing a Formation Service: A cost-effective and time-saving option.

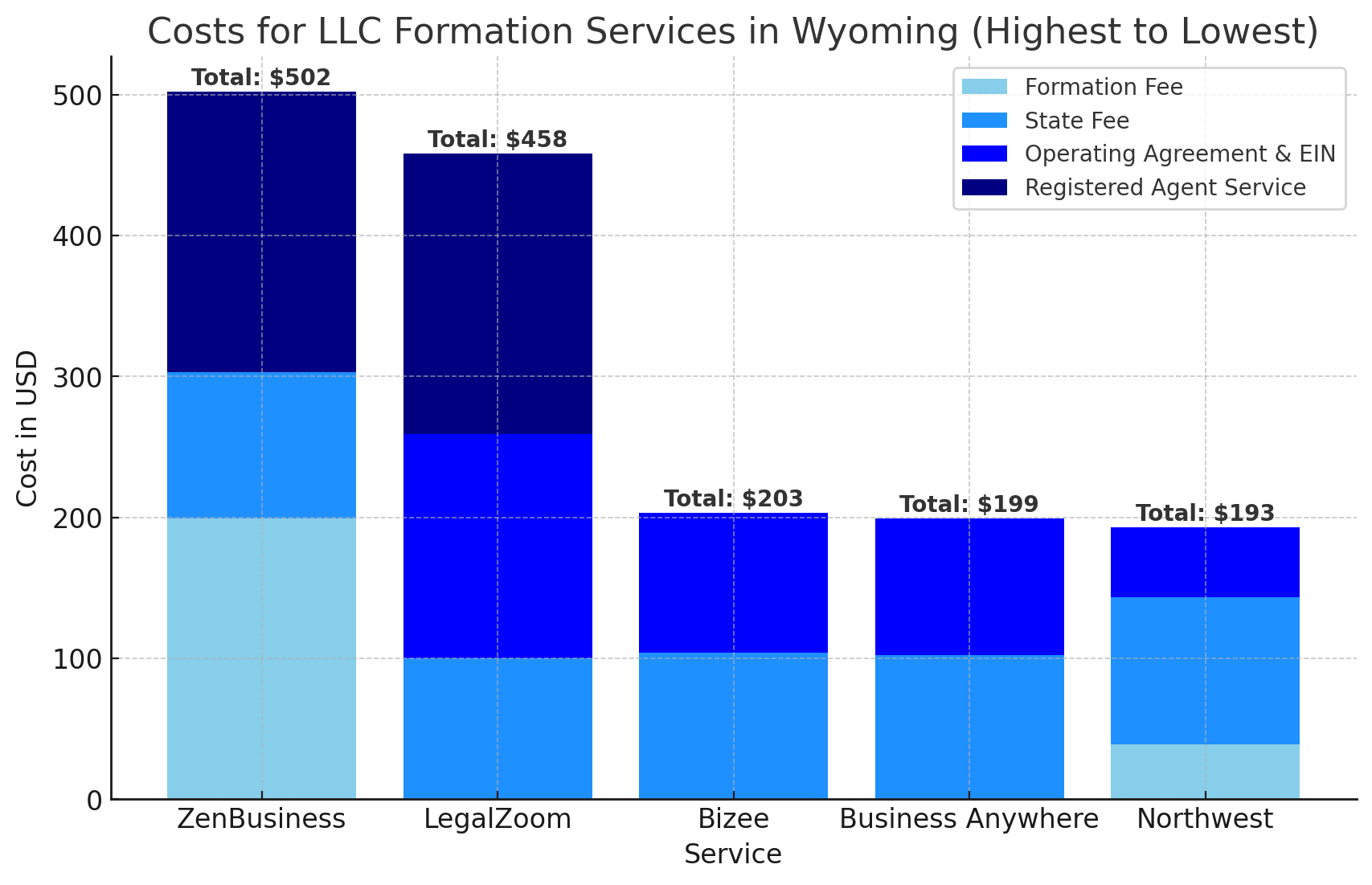

Formation services like Business Anywhere and Northwest Registered Agent can help you with everything from name checking to filing. Plus, they often include free registered agent services for the first year.

Use Business Anywhere to form your LLC for just $37 plus state fees. You can even save 15% on the service by using the promo code “BEGIN15” at checkout.

Steps to Start an LLC in Wyoming

1. Choose a Distinctive Name

Your LLC’s name must be unique and not already in use by another business in Wyoming. To ensure the name you want is available:

- Go to the Wyoming Secretary of State’s website and use their business name search tool to check availability.

- Your LLC name should include "Limited Liability Company" or its abbreviations like "LLC" or "L.L.C." for legal compliance.

2. Appoint a Registered Agent

Wyoming requires every LLC to have a registered agent—a person or business responsible for receiving legal documents on behalf of the LLC. You have two options:

- Be your own registered agent: This is free, but you must be available during normal business hours and publicly list your address.

- Hire a professional registered agent service: For more privacy and convenience, hire a service. Registered agents typically cost between $125 and $200 per year after the first year, which is often offered for free by formation services like Business Anywhere.

3. File the Articles of Organization

The next step is filing your Articles of Organization with the Wyoming Secretary of State. This document officially forms your LLC. Here’s what you need to know:

- The filing fee is $100 by mail or $103.75 if you file online (includes a small convenience fee).

- The Articles of Organization will include basic information about your business such as the LLC’s name, address, registered agent details, and purpose.

- You can file your Articles of Organization directly through the Wyoming Secretary of State’s website.

4. Obtain an Employer Identification Number (EIN)

An EIN is like a Social Security number for your business and is required if you have employees or if you want to open a business bank account. You can get your EIN for free from the IRS by following these steps:

- Visit the IRS website to apply for your EIN online. If you prefer a guided approach, check our step-by-step guide on obtaining an EIN.

- Use a formation service like Business Anywhere to obtain your EIN for $97, or go with Northwest Registered Agent, which offers the service for $50 if you prefer a more affordable option.

5. Create an Operating Agreement

Although an Operating Agreement is not required by Wyoming law, it’s a good idea to have one. An Operating Agreement outlines how your LLC will be managed and the roles of its members. It’s often required by banks when opening a business account.

- You can get a free template from Northwest Registered Agent, or you can work with Business Anywhere for $97 if you need help drafting and modifying the agreement.

6. Open a Business Bank Account

It’s crucial to separate your personal and business finances by opening a dedicated business bank account. Having a business bank account helps protect your LLC’s limited liability status. Most banks require:

- Your EIN,

- Your LLC’s Articles of Organization,

- And sometimes, your Operating Agreement.

Many business formation services, like Business Anywhere, can help you open a business bank account or provide necessary documents like banking resolutions for $27.

If you're looking to find the best 1st credit card for your business in 2024, check out our detailed review.

7. File a Beneficial Ownership Information Report

Starting in 2024, LLCs in Wyoming must file a Beneficial Ownership Information Report with the Financial Crimes Enforcement Network (FinCEN). This report details the primary owners of your LLC. Key details include:

- You have 90 days after forming your LLC to submit the report in 2024. In 2025, the filing window shrinks to 30 days.

- You can submit this report for free or pay a formation service around $25 to $50 to handle it for you.

8. Maintain Your LLC in Good Standing

To keep your LLC active and in good standing, you must file an annual report with the Wyoming Secretary of State. Here's what to expect:

- The minimum annual fee is $60 if your LLC’s assets are under $300,000. If your assets exceed that amount, you’ll pay 0.2% of your total assets. For instance, an LLC with $500,000 in assets would pay $100.

- There is also a small convenience fee for online filing ($2 for the minimum $60 fee).

Why Choose Wyoming for Your LLC?

Wyoming is one of the most popular states for LLC formation due to its favorable business laws and low fees. Here are some benefits of forming an LLC in Wyoming:

- Low Formation Fees: At just $100 for filing the Articles of Organization, Wyoming is one of the more affordable states to start an LLC.

- No State Income Tax: Wyoming does not impose personal or corporate income taxes, which can save business owners a significant amount of money.

- Strong Asset Protection: Wyoming offers strong protections for LLC owners, making it a popular choice for businesses focused on liability protection.

- Privacy: Wyoming allows LLC owners to remain anonymous in public records, providing an extra layer of privacy.

Conclusion

Forming an LLC in Wyoming is an excellent choice for entrepreneurs looking for a cost-effective and business-friendly state. Whether you decide to go the DIY route or use a formation service like Business Anywhere or Northwest Registered Agent, this guide covers all the steps to ensure your LLC is set up correctly and efficiently. Remember, maintaining your LLC in good standing by filing annual reports and keeping up with legal requirements is essential to protecting your business and ensuring long-term success.

Starting an LLC in Wyoming doesn’t have to be complicated—by following these simple steps, you can get your business up and running quickly and smoothly.

Frequently Asked Questions (FAQs)

Can I be my own registered agent in Wyoming?

Yes, you can act as your own registered agent in Wyoming. However, your name and address will be publicly listed, and you must be available during regular business hours to receive any legal documents in person.

How much does it cost to start an LLC in Wyoming?

The cost to start an LLC in Wyoming is $100 if you file by mail or $103.75 if you file online (including a small convenience fee). Additional costs may apply if you hire a registered agent or use a formation service.

What’s the difference between a member-managed and manager-managed LLC?

If you go for a member-managed LLC, the members (owners) will handle the day-to-day operations. In a manager-managed LLC, members hire managers to run things. These managers take care of tasks such as hiring and firing employees, managing credit and bank accounts, and signing agreements and contracts.

What should be included in an operating agreement?

A personalized operating agreement addresses both the day-to-day and overarching aspects of your company, encompassing everything from member responsibilities to the dissolution of the business. Here are common topics typically included in operating agreements:

- Initial investments

- Profits, losses, and distributions

- Voting rights, decision-making powers, and management

- Transfer of membership interest

- Dissolving the business

Do I need an EIN for my Wyoming LLC?

Yes, an EIN (Employer Identification Number) is necessary if your LLC has employees or if you want to open a business bank account. You can obtain an EIN for free directly from the IRS.